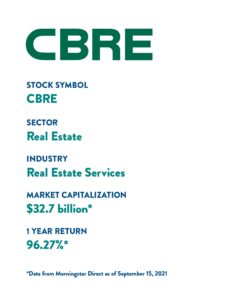

Impact Spotlight: CBRE

CBRE

CBRE focuses on real estate services to owners, occupants, and investors. This includes leasing, property, project, and investment management.

Buildings make up about 30% of all carbon emissions, making building efficiency a priority climate change issue. We value CBRE because of its strong focus on building efficiency. The company has been carbon neutral in its own operations since 2010 and works to help the buildings they manage and their clients achieve the same.

They help their clients procure clean energy for their buildings and operations, as well as work with academics and other industry leaders to better understand and advance sustainable practices. CRBE also complies with GRI standards for reporting.

In addition, they have a diverse board, promote diversity, equity, and inclusion among their employees, and are active in their communities.

The company has received numerous awards for its responsibility, including Fortune’s World’s Most Admired Companies for eight straight years, Dow Jones Sustainability Index for six years, Barron’s Most Sustainable Companies, CR Magazine’s Best Corporate Citizens, and the Bloomberg Gender-Equality Index.

From an investment perspective, CBRE survived the pandemic and is well prepared for the new work paradigm. Despite the extreme circumstances, revenue for 2020 was basically flat from 2019, which we view as a victory. While operating performance (ROA, ROE) was off, we expect it to return to pre-pandemic levels in 2021, as should net income.

CBRE has been included in the Green Sage Sustainability Portfolio since June 2019 and we expect it to remain through this quarter’s review and rebalance. CBRE continues to meet and exceed both the sustainable and fundamental metrics required for inclusion in the portfolio. As we say, it’s never a bad time to buy a great sustainable company.

About This Series

The world of sustainable, responsible, and impact investing is often surrounded by confusion and conspiracy. Our Impact Spotlights are designed to give you a glance into the value we bring with nearly 20 years of experience aligning our clients’ investments with their values.

It’s important to note that this is not a deep dive. For each of our investments, we start with a base of proven, fundamental economic analysis – this is the data that every “traditional” asset manager evaluates (e.g., price/earnings ratios, debt levels, growth, etc.). But then we dig deeper and apply our proprietary five-step evaluation to each of our considerations to ensure that each company in our final portfolio meets our rigorous standards. The Impact Spotlight explores the executive discretion we’ve applied to not-so-obvious solutions.

This blog was published on September 16, 2021 and may not be reflective of current portfolio holdings. Past investment performance is not indicative of future results. This blog is for informational purposes and should not be construed as advice. Investment advice can only be given to clients who have a signed investment advisory agreement with Earth Equity Advisors, LLC in place.