[ Financial Planning ] Doing Right by clients and the planet with SRIs

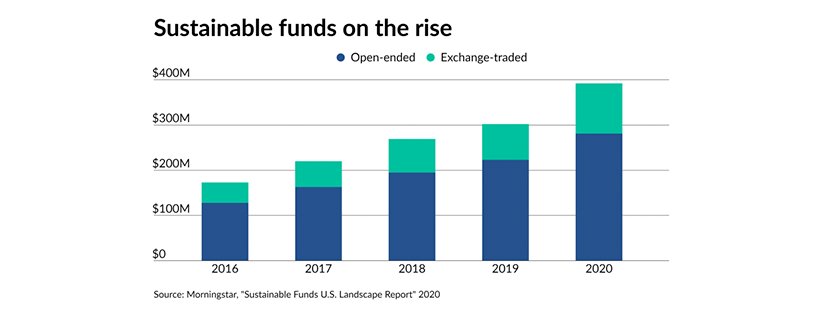

It seems like every day a new socially responsible fund pops up.

In 2020 alone, 90 new funds were brought to market. Moving into 2021, there were 392 such sustainable fund offerings comprising $51.1 billion. And they’re quickly adding new assets — 40% of that $51.1 billion came in the fourth quarter alone — and there’s no signs of slowing.

That’s a lot of a lot of choice, and as anyone who has ever tried to decide on which restaurant to pick for dinner with their spouse, having too many choices is not always a good thing.

So how do you wade through the ever-growing abundance of sustainable funds to choose the right ones for your client?

Carefully and intentionally.

Let’s start by defining a couple of terms:

- Sustainable, responsible and impact investing (SRI, formerly known as socially responsible investing) combines environmental awareness (e.g., climate change) with social good and direct impact. It typically involves a more qualitative research process as opposed to ESG.

- Environmental, social and governance (ESG) is a method of analysis that focuses on the above three metrics. It is often used to create indexes composed of best-in-class companies. It’s typically a quantitative research process.

My firm, which specializes in responsible investing, favors actively managed SRI funds over ESG index funds because of the “greenwashing” that often happens with ESG funds. An index cannot take into account the gaming of the system that can, and does happen. For example, when a fossil fuel company strategically increases charitable funding to get a better “social” score or adds a woman or person of color to their board to improve their “governance” score. ESG metrics are a good starting point, but we believe that human eyes must monitor and review the holdings to ensure that a fund that calls itself responsible is actually responsible.

That’s why I believe the most important aspect of choosing a responsible fund is its underlying holdings. There are a lot of funds out there that claim to be “responsible,” “carbon light” or to have ESG screens, but you would never know by looking at their portfolios. Some contain eco-unfriendly holdings such as ExxonMobil, McDonald’s and DuPont, to name a few.

‘Less bad’ no good

By contrast, our firm has chosen to only use fossil fuel-free funds. While some argue that you need a seat at the table to change fossil fuel companies, we believe that investment dollars are better utilized in climate change solutions and not climate change causes. Plus, the energy industry has actually seen a negative annual return over the past decade (based on the Energy Sector SPDR, XLE). Given that, we consider fossil fuel-free to be a risk management decision as well as a values decision.

We also like to see holdings that are offering positive sustainability solutions — and not just Tesla, but a variety of sectors including IT, green building, water, recycling and green finance. We aren’t looking to be “less bad,” but to actually make a positive impact. We have found this to be very important for our sustainability-minded clients.

As someone who cares about transparency and the future of our planet, I believe it’s important for a fund company to have sustainability values at its core and is not just capitalizing on the growth of ESG/SRI investing. While this isn’t always possible with every asset class, we make it a priority when it makes financial sense.

Value added

And speaking of financial sense, as a fiduciary, we have a responsibility to balance our clients’ desires to invest responsibly while maximizing return based on their respective risk tolerances. Back when I started investing my client’s assets in a socially responsible manner in 2004, this wasn’t always easy to do. However, as the SRI industry has matured, and more companies have made sustainability a priority, competitive performance has become much easier to find.

According to a Feb. 25, 2020 Morningstar report, “Three out of every four sustainable equity funds finished in the top half of their category and 43% posted top-quartile returns. By contrast, the returns of only 6% landed in their category’s bottom quartile.” Responsible funds often have lower risk metrics because they avoid the perennial corporate offenders which can drag down performance.

There is no reason to avoid sustainable, responsible, and impact funds. In fact, and as performance has shown over the past several years, there is every reason to consider them — even in your non-SRI clients’ portfolios.

Wayne Gretzky said “skate to where the puck is going, not to where it’s been.” Similarly, the best managed sustainable funds are investing where the economy is going, not where it’s been.

Originally published in Financial Planning.

Getty

Getty ZUMA PRESS

ZUMA PRESS

Getty

Getty