[ MarketWatch ] Buyer beware: What’s really in your ‘earth-friendly’ ESG fund?

Some socially conscious mutual funds and ETFs own stocks that seem strangely out of place.

Sustainable, responsible, and impact (SRI) investing used to be dominated by mutual fund companies whose mission was to align their investment strategies with their values. Companies such as Calvert, Domini, Parnassus, and Pax World invested responsibly to make the world a better place. Most of their investment managers took a hands-on approach to portfolio construction — understanding the companies and industries they invested in and their impact on the planet.

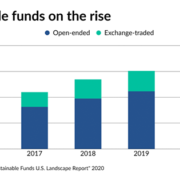

Over the past decade, SRI investing strategies have become more mainstream. In 2017, Morgan Stanley’s Sustainable Signals research paper found that there is strong interest in responsible investing, particularly from millennials (86%) and from women (84%). According to the 2020 US SIF, investors are considering ESG factors across $17 trillion of professionally managed assets, a 42% increase since 2018.

Yet this increased popularity means bigger firms went looking for easier ways to jump on the SRI bandwagon. The more time-consuming research undertaken by legacy firms didn’t play well with the new, low-cost, index-focused investment landscape. ESG (Environmental, Social, Governance) research was born out of this desire to cut costs and quantify sustainable, responsible, and impact investing. ESG research breaks down a company by the three components and often rates them relative to their peers. Theoretically, a fossil fuel company could score highly because they are doing “better” than their less-responsible peers.

ESG + greenwashing

With ESG ratings, it’s easy for companies to game the system. Let’s use a fossil fuel company as an example again. It will never score high on the environmental portion, so it works to prop up its numbers through social and governance. This company might increase its charitable donations to increase the “S” score, and might add a woman or person of color to the board to improve the “G” score. These moves aren’t responsible — they’re deceptive. ESG ratings are an excellent starting point, but to have a genuinely sustainable portfolio, you need to monitor the holdings.

When you use the ESG approach without human oversight, the portfolios you end up with are usually just watered-down versions of their underlying benchmark. As green architect and co-author of the book “Cradle to Cradle,” William McDonough, says, “Being less bad is still bad.” These portfolios are just less bad. ESG investing is not sustainable, responsible, or impact investing.

Investors and advisors may ask, what’s wrong with using funds that are less bad? Well, nothing is wrong with it – if there were no alternatives. The danger lies when an investor believes they are investing responsibly when they buy one of these less bad funds. Unfortunately, many of them are marketed using terms such as “best in class,” “sustainable” or “low carbon.” This is greenwashing.

Greenwashing is defined as “the process of conveying a false impression or providing misleading information about how a company’s products are more environmentally sound.” The reality is that most of the new ESG index funds are greenwashed when you take a look under the hood and check out the underlying holdings. So, let’s take a look at two of the largest ESG funds and see how sustainable they are.

Looking under the hood

First up is iShares ESG Aware MSCI USA ETF ESGU, +1.13%. Because of heavy marketing, this BlackRock fund has seen dramatic inflows of assets since its inception in 2016. With more than $13 billion invested, it’s the fastest-growing fund of its class. According to investment researcher Morningstar, the ETF has 347 holdings. Here are some of the stocks in the portfolio as of March 8:

Fossil fuel companies: Exxon Mobil; Cheniere Energy; Chevron; ConocoPhilips; Kinder Morgan; Marathon Energy; Hess; Philips 66; Occidental Petroleum; Schlumberger and Valero Energy.

Fossil fuel utilities: NextEra Energy; Public Service Enterprise Group, ONEOK.

Defense contractors: L3Harris; Huntington Ingalls, Raytheon

Industrial: 3M; Caterpillar; Dow; DuPont; General Electric; Kimberly Clark; Newmont Mining, PPG Industries.

Big agriculture: Archer Daniels Midland; Conagra; Corteva, Hormel Foods.

Financials: JPMorgan; Citigroup, Goldman Sachs.

Gambling: MGM Resorts.

Consumer-oriented: Amazon.com; Facebook; PepsiCo; Coca-Cola; McDonalds, Keurig Dr Pepper.

Included are companies contributing to climate change and the obesity epidemic, firms with longstanding superfund liabilities, big banks funding the fossil fuel industry, defense contractors, a gambling company, and a controversial social media company. How is this marketed as ESG?

If BlackRock were engaging these companies with proxy votes like traditional SRI fund managers do, it might have an excuse. According to a recent Morningstar report, iShares ESG Aware had 35 opportunities to vote for sustainability-related shareholder issues in 2020. The fund voted in favor just 9% of the time. It is not using shareholder advocacy to change these companies.

Blackrock CEO Larry Fink has been writing about ESG issues in his annual letter every year since 2016. He writes a great letter. However, his rhetoric does not seem to have an impact on the funds that Blackrock manages.

Next up is the Vanguard FTSE Social Index Fund VFTNX, +0.37%, which has been around since 2003 — considerably longer than ESGU. With nearly $11 billion in assets, this fund is a big player in the sustainable, responsible and impact investing marketplace. While it does eliminate the energy sector, the fund does not exclude utilities that are overwhelmingly based on fossil fuels. According to Morningstar, it has 468 holdings. Here are some of the questionable ones as of Jan. 31, the most recent reporting date:

Fossil-fuel utilities: Atmos Energy; CenterPoint Energy; PPL; Sempra Energy; CMS Energy, Alliant Energy.

Industrial: Caterpillar; Westlake Chemical; DuPont; Newmont Mining; Kimberly Clark; Dow; LyondellBasell; International Paper; Martin Marietta Materials; Celanese, Eastman Chemical.

Big agriculture: Corteva; FMC; Conagra, CF Industries

Transportation: PACCAR; Ford; Old Dominion Freight Line; Southwest Airlines, Delta Airlines.

Financials: JPMorgan, Goldman Sachs.

Consumer-oriented: Tyson Foods; Amazon.com; Facebook; PepsiCo; Coca-Cola; McDonalds; Hershey; Keurig Dr Pepper; Hormel Foods, Yandex

As with BlackRock, one has to question this index methodology. Like BlackRock, Vanguard is not voting positively on sustainability-related proxies. In 2020, this fund had 45 opportunities to vote yes and did so only 18% of the time.

There’s also a lot missing in both of these funds — where are the solar or wind stocks? Sure, there’s Tesla, but it’s a significant component of the underlying benchmark. How about natural and organic products, green building, or the recycling and circular economy? How can a fund be considered sustainable if it doesn’t include companies making a positive impact on the environment? Sustainable investing is not just about excluding the bad — it’s also about including the good.

The recent gold rush mentality of the sustainable, responsible and impact investing industry has created ample opportunities for greenwashing. Just because the CEO writes a great letter or a fund markets itself as “ESG” or “sustainable” doesn’t mean it’s so. It is up to the investor or financial adviser to conduct their due diligence and look under the hood to see what the fund is really investing in. If it doesn’t look right, it probably isn’t.

Originally published in MarketWatch.

Photography: ZUMA PRESS

ZUMA PRESS

ZUMA PRESS

Getty

Getty